Designing an Effective Omnichannel Collections Strategy

Effective debt collection requires a comprehensive approach that reaches customers through multiple channels while maintaining efficiency and compliance. Relying solely on phone calls can limit engagement, especially as consumer preferences evolve. An omnichannel strategy enables organizations to communicate consistently across voice, text, and email, increasing responsiveness and improving recovery rates.

Omnichannel Collections (Voice, Text, Email) provides a framework for modern collections operations. Platforms like Omnichannel Collections (Voice, Text, Email) help organizations integrate multiple communication channels into a cohesive workflow, ensuring that all customer interactions are professional, timely, and aligned with regulatory requirements.

Understanding Omnichannel Collections

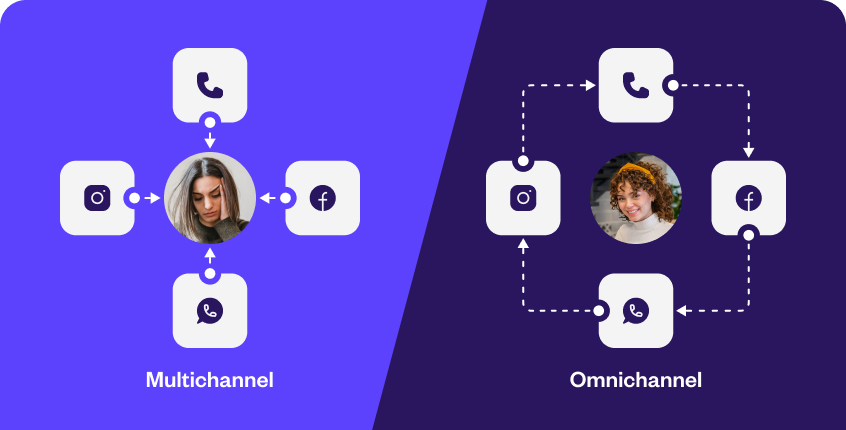

Omnichannel collections refers to the coordinated use of multiple communication channels to engage customers. Voice calls remain effective for personalized interactions, while text messages and emails offer convenient alternatives for reminders, notifications, and updates. Combining these channels allows organizations to reach customers where they are most likely to respond.

An integrated approach ensures that messages are consistent, relevant, and tailored to each customer’s behavior and preferences, which enhances overall engagement.

Benefits of an Omnichannel Approach

Adopting an omnichannel strategy improves collections outcomes in several ways. First, it increases the likelihood of reaching the customer promptly by providing multiple points of contact. Second, it allows organizations to segment communications based on customer preferences and account history, improving personalization and response rates.

Additionally, omnichannel collections streamline internal workflows, reduce manual tracking, and provide comprehensive visibility into all customer interactions.

Personalizing Customer Communications

Personalization is critical for maximizing engagement. Omnichannel platforms can tailor messaging based on payment history, outstanding balance, and previous interactions. For example, a customer who frequently responds to text messages may receive reminders via SMS, while another may prefer detailed email updates.

Targeted messaging improves the likelihood of timely payments, fosters positive customer relationships, and enhances the overall collections experience.

Automating Workflows

Automation is a key component of an effective omnichannel strategy. Platforms can automatically trigger reminders, schedule follow-ups, and escalate accounts based on payment behavior. Automation reduces manual effort, ensures timely communication, and allows staff to focus on complex or high-value cases.

By standardizing workflows across voice, text, and email, organizations can maintain consistency and efficiency in all customer interactions.

Ensuring Compliance

Debt collection is governed by federal and state regulations, including the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA). Omnichannel collections platforms integrate compliance features into workflows, ensuring that all messages adhere to legal guidelines and minimizing the risk of violations.

Automated logging of interactions provides an audit trail, supporting regulatory compliance and internal accountability.

Leveraging Analytics

Analytics play a critical role in optimizing omnichannel collections strategies. Platforms track key metrics such as response rates, repayment trends, and channel effectiveness. Data insights allow organizations to refine communication strategies, allocate resources efficiently, and continually improve collections performance.

Regularly analyzing performance helps teams understand which channels and messages drive the best outcomes, ensuring maximum ROI.

Enhancing the Customer Experience

An omnichannel strategy balances operational efficiency with customer satisfaction. Providing multiple communication options and delivering messages in a professional, personalized manner reduces frustration and increases engagement. Customers are more likely to respond positively when they can interact through their preferred channel.

Focusing on the customer experience also helps preserve long-term relationships while ensuring timely repayment.

Conclusion

Designing an effective omnichannel collections strategy requires integrating voice, text, and email into a coordinated workflow. By leveraging automation, personalization, analytics, and compliance features, organizations can enhance engagement, reduce manual effort, and improve recovery rates. Implementing a structured omnichannel approach enables finance teams to manage collections more efficiently while providing a professional, consistent experience for all customers, supporting both operational success and positive customer relationships.